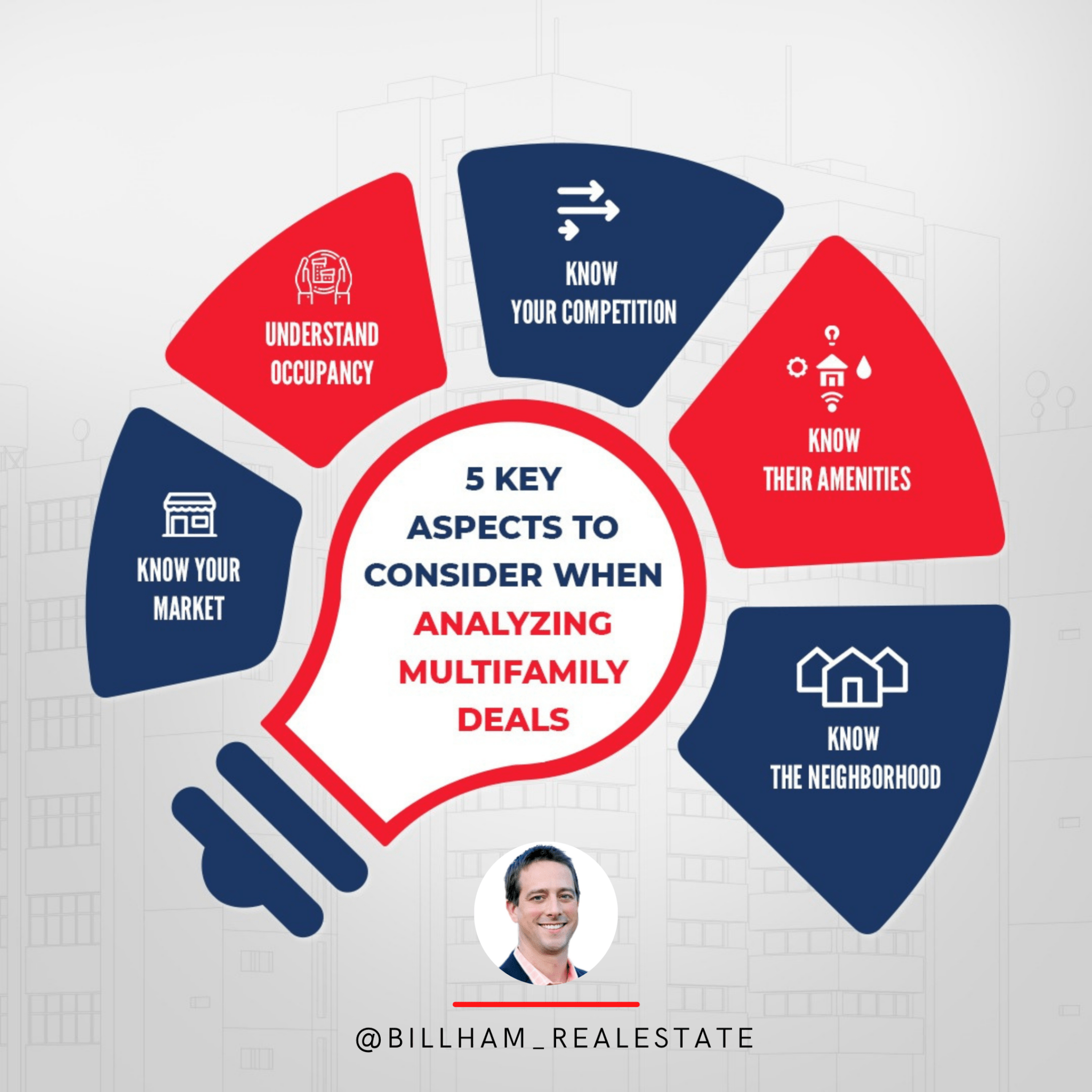

Doing proper due diligence on a property before you buy...

Read MoreWORLD-CLASS TRAINING FOR THE BEGINNER TO THE SEASONED INVESTOR

Bill Ham’s comprehensive training programs aim to teach you A to Z of Multifamily Real Estate Investing.

Whether you are a beginner or an experienced investor, the courses will enhance your learning curve as Bill shares his 16 years of Investing experience with practical tips, proven strategies and frameworks through which he has acquired thousands of apartments.

Learn more about each program below, and see which is right for you.

Sign-up Now! Limited Time, Free Training Program

In this training, Bill Ham answers the key queries that you would have on your mind before investing in Real Estate. The training covers the key questions such as:

- Should I Start Investing In Real Estate?

- What Will It Take?

- How Do I Do It?

Sign up now. Limited time offer.

Why Learn From Bill Ham

In 2005 I quit my job as a corporate pilot and went into real estate full time. I had closed only one deal. A duplex. It was cash flowing about $300 a month. I started my entire real estate carrier with this one duplex and a life savings of $10,000. Not much.

My first 402 units were completed with some form of creative financing such as seller financing and master lease options.

16 Years+ Real Estate Investing Experience

Commitment To Educate Investors

Raw Uncut Training With Real Life Case Studies

Real Estate Raw

A step-by-step instruction manual to building a real estate portfolio from start to finish

Is investing in real estate right for you? Do you know how to get started?

If you have been asking these questions, Real Estate Raw is a must read for you. This book

gives you a step-by-step instruction manual to building a real estate portfolio from start

to finish.

In Real Estate Raw you will learn how to:

• Choose a real estate market

• Get deals from that market

• Analyze deals for cash fl ow

• Raise private money

• Close deals

• Do it all over again!

Let Bill show you how to build a lasting real estate business with a no-nonsense approach

to real estate. If you have your “WHY”, this is the “HOW” you have been looking for.

Creative Cash

The Complete Guide to Master Lease Options and Seller Financing for Investing in Real Estate

Think you can’t afford to invest in multifamily real estate?

Now, you can. Discover the best-kept secrets of the two creative, effective financing strategies other investors don’t want you to know about: Master Lease Options and Seller Financing.

I used these strategies to buy his first 400 units without ever stepping into a bank or qualifying for a loan.

In Creative Cash, you’ll learn step-by-step how to:

- Buy property without ever stepping into a bank

- Identify the best emerging markets

- Find the right deals

- Analyze and underwrite those deals

- Make offers and perform due diligence

- Negotiate successfully

- Come out ahead with exit strategies for creating wealth

Let me show you how to close your next deal with little to no money down using the hottest strategies in real estate—leveraging other people’s money to come out ahead.

Real Estate Insights

How Does Seller Financing Work In Multifamily Investing

Seller financing is my favorite form of creative financing. Seller...

Read MoreFirst 3 Steps to Using a Master Lease Option

Lease options are a great tool to use when building...

Read MoreReal Estate Raw: A step-by-step instruction manual to building a real estate portfolio from start to finish

What’s your why? Everyone needs a good reason to be in...

Read MoreMultifamily- Market Cycle or a Paradigm Shift?

Source: Berkadia.com Are multifamily properties in the United States going...

Read MoreHow Distressed Assets Could Be Your Ticket to the Best Real Estate Deals

The following is adapted from Creative Cash by Bill Ham (author), Gino Barbaro...

Read MoreCreative Ways to Overcome the Barriers to Entry in Real Estate

The following is adapted from Creative Cash by Bill Ham (author), Gino...

Read MoreWhat You Must Understand About Real Estate Before Closing Your First Deal

The following is adapted from Creative Cash by Bill Ham, Gino Barbaro, Jake...

Read MoreWant the Best Multi-Family Real Estate Deals? Start with Problems.

The following is adapted from Creative Cash by Bill Ham. There’s one...

Read More