A look at how federal stimulus money has caused the failure of some regional banks.

I propose the theory that the federal reserve’s economic response to the Covid-19 pandemic has and will continue to damage the U.S. banking system.

Stimulus money is the culprit of most of the interest rate raises we have seen over the last year. The federal reserve raises interest rates according to inflation levels. Basically put, inflation is when there are too many dollars in circulation and each one falls in value and therefore purchases less goods and services over time.

The more dollars in circulation, the more inflation. The federal reserve raises or lower interest rates to move money in and out of the market to control inflation…usually.

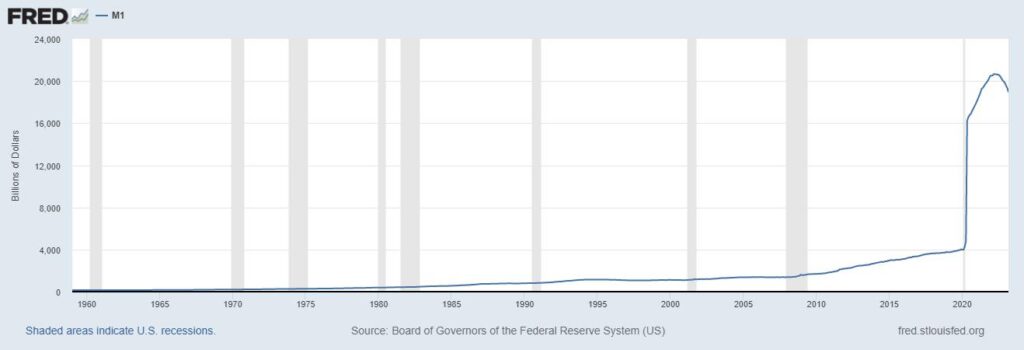

As the old saying goes, “a picture is worth a thousand words” but a graph from the federal reserve showing how much money was placed into the U.S. banking system in less than 18 months might leave you speechless. It did me. https://fred.stlouisfed.org/series/M1SL

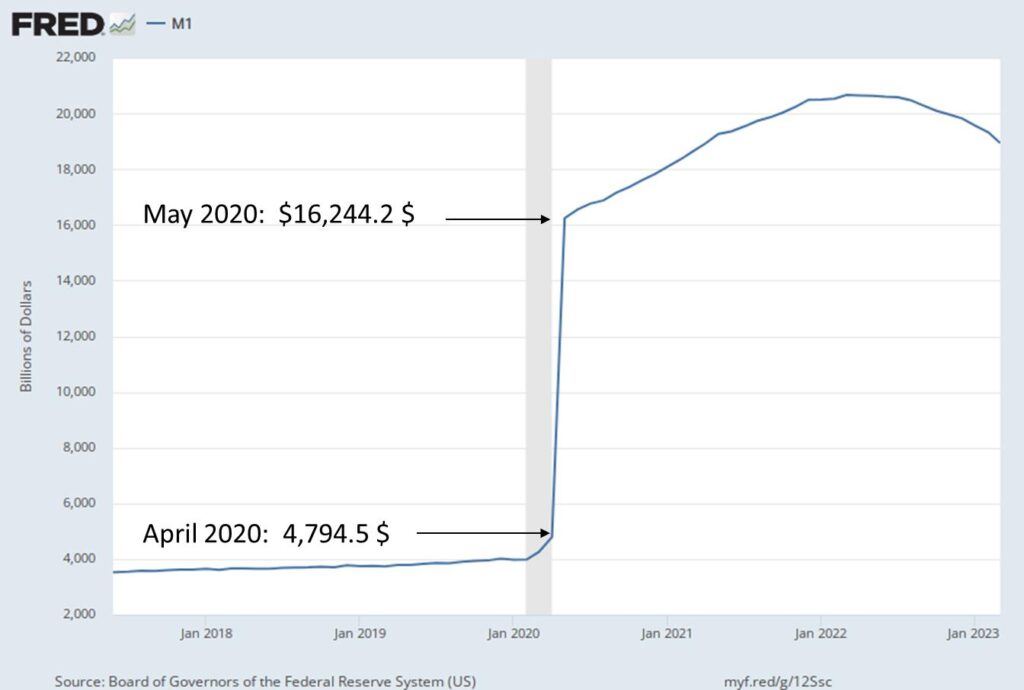

Following the data provided by the Board of Governors of the Federal Reserve System (US) we can see that in April 2020 the U.S. financial system started with approximately $4.7 billion in circulation. This is called M1.

By May of the same year the federal government had injected approximately $11,450 billion into the M1 supply. This was in response to the lockdowns happening at that time due to the covid-19 outbreak and ensuing pandemic. The capital was placed into the economy in various ways such as the Stimulus and Relief Package 1 & 2, the Paycheck Protection Program (PPP), the Economic Injury Disaster Loans and more.

Besides the obvious fact that the federal government injected more cash into the economy in one single event since 1960 (and I would venture to say EVER), there is a more concerning issue. This cash inflow bypassed the usual method of monetary control in the U.S. economy. Federal bonds.

The federal reserve moved this massive amount of cash into the system without the usual issuance of bonds and their applicable interest rates. This has caused a series of subsequent events in the economy as a result.

Pre-Covid the federal reserve would regulate the flow and amount of M1 in the economy by issuing treasury bonds.

When the federal government wants there to be more money (M1) in the economy they buy bonds from the general population. When they want to remove money from the system, they sell bonds. A simple explanation of a government bond is an IOU from the United States Government. Each bond has an interest rate that it pays annually and a maturity date. At the maturity date the bond is redeemed for the face value or the original invested amount.

Now let’s discuss inflation. Inflation occurs when the government produces too much M1 in a given period of time and the buying power of the dollar falls. This is due to simple supply and demand. If everyone has money…its less valuable and buys less.

When the Feds decide there is too much M1 sloshing around in the economy, they sell bonds. Once their money is received for the bond, they simply delete it from the federal ledger. Remember that it’s all 1s and 0s in today’s world. Not greenbacks anymore.

Interest rates- when the Feds want M1 flowing to their coffers they raise the interest rates on the bonds that they are issuing. The U.S. bond has long been considered one of the world’s most secure investments as it is backed by the U.S. government and when they pay out at higher interest rates, they become a more attractive investment.

This means that the government is now competing with the local, regional, and national banks for those same deposit dollars. Now depositors have a choice. Put their money into an account at their bank or buy a bond. When the rates go up on bonds the banks must raise the rates, they pay out deposits to keep those dollars in their accounts and not let them go to the Feds.

Banks use depositor money to lend to borrowers. If they must pay the depositor more on their money, they have to charge a higher rate on their loans. And that’s how rates go up and down for loans. It’s not set by the Fed directly, but it is a function of the interest rates they pay out on competing bonds.

What if the government skips the issuance of bonds and injects over $11 billion into the system in just a few months via various stimulus measures? I don’t know either, but we are all about to find out.

Why did Silicon Valley Bank and Signature Bank collapse? I propose the answer is “they caught Covid”!

The pandemic caused the government to issue a lockdown to prevent the spread of the Covid-19 virus. They believed that locking down the economy would damage it significantly. To resolve this, they issued stimulus measures. Depositors put all that cash into their local, regional, and national banks. Those banks now flush with cash (more than they could lend) buy the “safest” investment in the world. Government bonds.

Now that the world is awash in this newly found stimulus money… inflation kicks in. What does the federal government do? Raise the rates it pays out on the bonds it is NOW issuing. I emphasize now because the rates that were being paid out on the bonds issued before covid were near 0%. The new bonds issued were at much higher rates, which effectively lowers the face value of older bonds. Not a problem… unless you NEED to sell. Then you take a “paper loss” on a ledger and turn it into a bank failure.

Depositors became fearful as they saw the banks reports start to show the “paper losses” on their bond investments. The depositor started to pull money from accounts that were not secured by the FDIC. This caused the banks to sell those bonds (at a real loss) to cover the depositors’ requests. Bank run.

These banks are victims of the continual economic effect of Covid-19 and the federal government’s response to it. I am not pointing fingers at any group or political party. It’s just what happened.

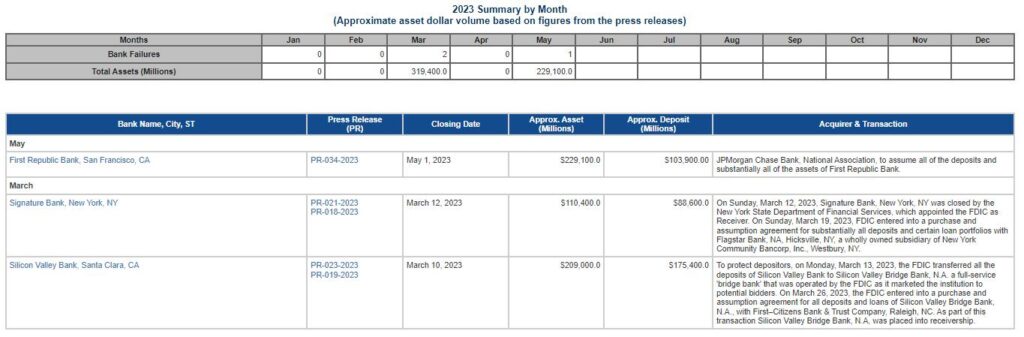

Update- 5-1-23

As I am writing this article a 3rd U.S bank has failed and been seized by regulators.

Failed Bank Information for First Republic Bank, San Francisco, CA

On Monday, May 1, 2023, First Republic Bank was closed by the California Department of Financial Protection and Innovation and the Federal Deposit Insurance Corporation (FDIC) was appointed Receiver.

My Predictions/Suggestions

- Banking and lending will be less available and more expensive in the future. This will have a compression effect on debt ratios, therefore ultimately lowering prices.

- This will create a great opportunity for new buyers in the market to pick up distressed assets or good assets from distressed sellers.

- If you are thinking about selling a real estate asset, you should consider the affect inflation will have on your cash. It loses value every day. Also consider whether you have a higher and better use for the money.

- I predict that rates will remain around 7% for commercial loans from community lenders and around 6% for agency and CMBS loans. This will remain in place for about 3 years before any rate decline.

- Understand that lenders will not likely lend on deals that have distressed financials or don’t cash flow. 1.25% DSCR is always a good rule of thumb. If your deal doesn’t produce that… put down more cash or lower the price.

For more information like this check out my articles at www.RealEstateRaw.com.