What happens when multifamily interest rates rise above cap rates?

In today’s dynamic real estate market, multifamily investments offer the potential for strong returns, but navigating this asset class requires a keen understanding of key financial metrics. Two such metrics, cap rates and interest rates, play a crucial role in determining the profitability of a multifamily property. This article delves into what happens when interest rates climb above cap rates, explores alternative factors to consider beyond cash flow, and offers insights into navigating this scenario for a potentially successful multifamily investment.

When interest rates for multifamily loans rise above capitalization rates (Cap Rate), it’s generally understood that you’re not making money directly from the rental income (operating income). No cash flow!

Cap Rate:

This represents the expected annual return on your investment property, calculated as Net Operating Income (NOI) divided by the property value. For example, if a property generates $10,000 in NOI per year and has a value of $100,000, the cap rate would be 10% ($10,000/$100,000).

Lending Interest Rate: This is the rate you pay on the money you borrow to purchase the property. Higher interest rates mean higher borrowing costs.

The Issue:

When the cap rate is lower than the interest rate, it means the rental income isn’t sufficient to cover both the loan payments and your desired return. In other words, you’re essentially paying more in interest than you’re earning in rent.

How important is cash flow? I would argue that its important but just because a deal does not cash flow does not necessarily make it a “bad deal”. I have personally completed many highly lucrative multifamily investments that never cash flowed but still produced great returns.

When looking at a property that needs heavy renovations, it is not uncommon for the property to not cash flow as the renovations are being completed and during the stabilization period in which the newly renovated units are brought “online”. While creating cash flow is ultimately important it is not the only factor that should be considered when analyzing a multifamily investment opportunity. Here are a few other things to consider.

- Total Return: While negative cash flow from rent isn’t ideal, investors often factor in potential property appreciation when calculating their total return. If the property value increases significantly over time, it can still be a profitable investment.

- Tax Benefits:Tax advantages are another saving grace when interest rates surpass cap rates. Depreciation allows you to deduct a portion of the property’s value from your taxable income each year, essentially reducing your tax burden. Additionally, deductions for repairs, maintenance, and mortgage interest can further offset negative cash flow. Remember, consult a tax advisor to fully understand the tax implications specific to your situation, but these benefits can significantly improve the overall return on your investment.

- Leverage: If you have a large down payment and use less borrowed money, the impact of the interest rate can be lessened.

- Specific Property: Some properties, like luxury apartments in high-demand areas, might have lower cap rates but attract higher rents, potentially making them viable investments even with high interest rates.

Data and Historical Examples:

While writing this article I set out to find the average cap rate for multifamily over the last 30-50 years. Apparently, there is no actual record of this data. There are too many variables (market, condition, age, etc.) to be able to decisively say what the cap rates were over that period.

I have been in the multifamily business as an owner operator for 20 years and I can personally tell you that from my experience the cap rates over that period have been on average between 5-8% for most multifamily properties with occasional exception.

Here is a breakdown from the information I have found on historical multifamily capitalization rates in the U.S market over the last 40 years. Remember, this is a very general estimate and may not reflect specific markets or property types.

- Early 1980s:Following high-interest rates and a recession, cap rates could have been in the 8-10%

- Late 1980s and 1990s:As the economy improved and interest rates dropped, cap rates likely compressed to the 6-8%

- Early 2000s:Another recession might have pushed cap rates back up to the 7-9%

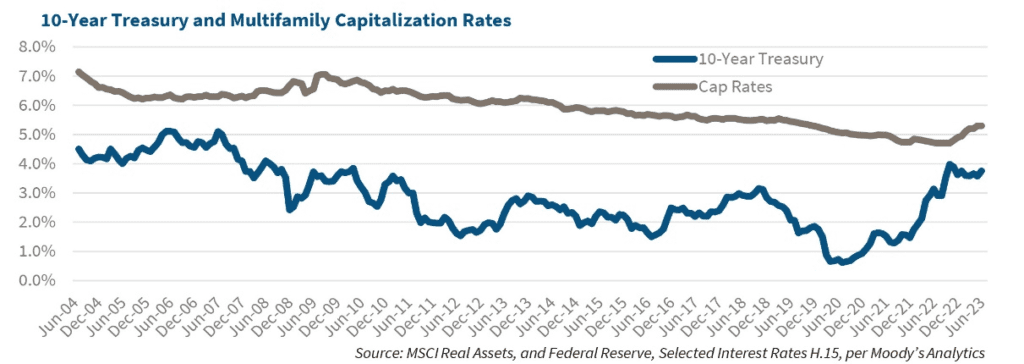

- Mid 2000s to Late 2010s:A strong economy and low-interest rates led to a period of “cap rate compression,” with averages potentially reaching 5-7%. I personally remember these caps.

- Early 2020s (present):Rising interest rates are likely causing cap rates to creep back up, possibly towards the 6-8% range again after dipping into the 3-4% range in 2022.

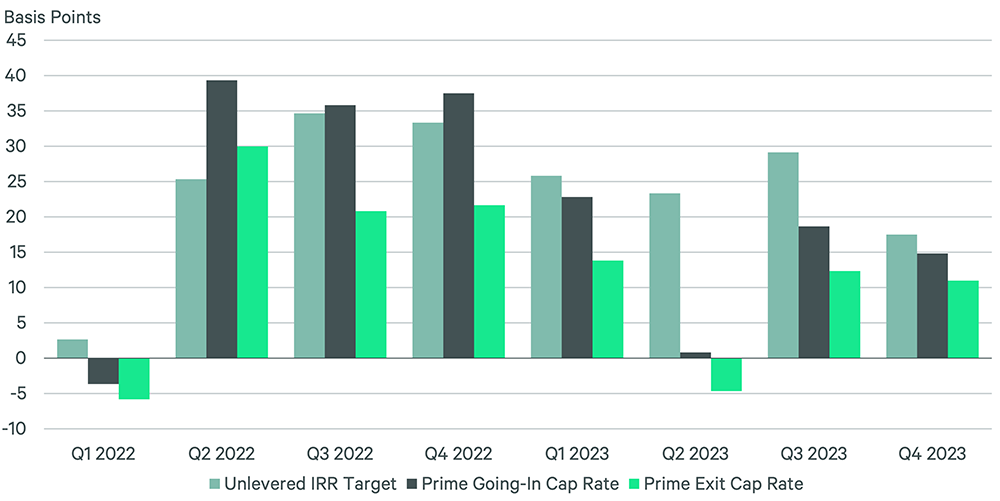

According to a report by www.cbre.com, the average cap rate for multifamily properties in Q4 2023 (U.S. market) was 5.06% and considerably lower than that in Q1 2022 and Q2 of 2023.

Source: CBRE Research, Q4 2023.

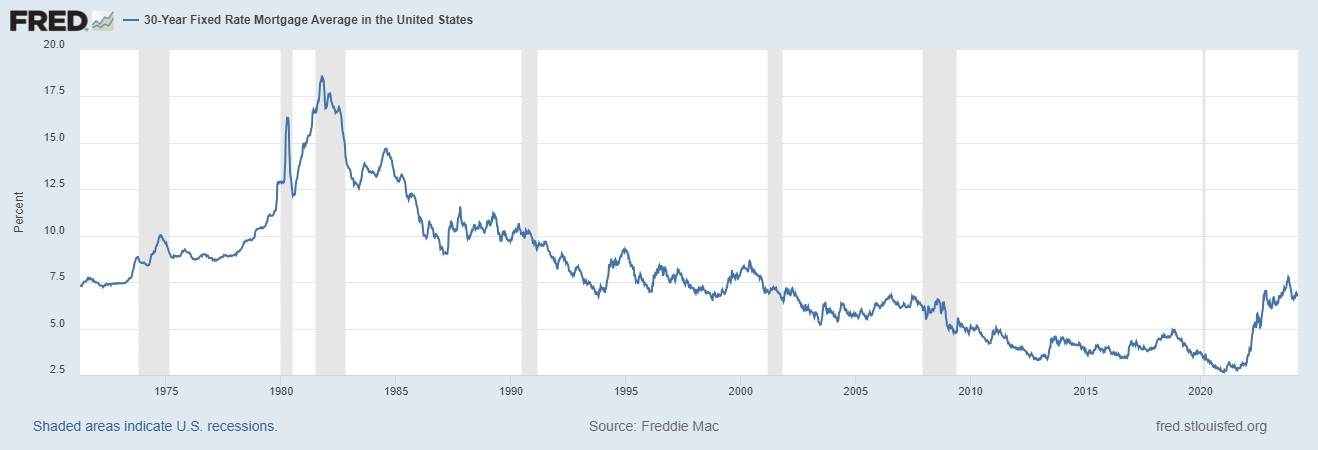

Meanwhile, interest rates have fluctuated throughout history. For example, during the early 1980s, interest rates reached highs of over 15% (source: Federal Reserve) leading to a significant decline in real estate values.

This isn’t to say every interest rate hike above the cap rate will trigger a crash. However, it highlights the potential impact on pricing. In the late 1980s and early 1990s, the S&L crisis led to stricter lending standards, further limiting access to capital for real estate investors. This, coupled with a moderate rise in interest rates, resulted in a period of stagnant or declining property values.

While not an exact parallel, these historical examples demonstrate how rising interest rates, especially when combined with other economic factors, can put downward pressure on multifamily prices. It’s important to note that these are just a few snapshots, and the real estate market is complex with various factors influencing price movements.

Overall:

While a cap rate lower than the interest rate can be concerning, it’s not an absolute rule. A thorough analysis considering all factors, including potential appreciation, taxes, and leverage, is crucial before making any investment decisions.

My Prediction:

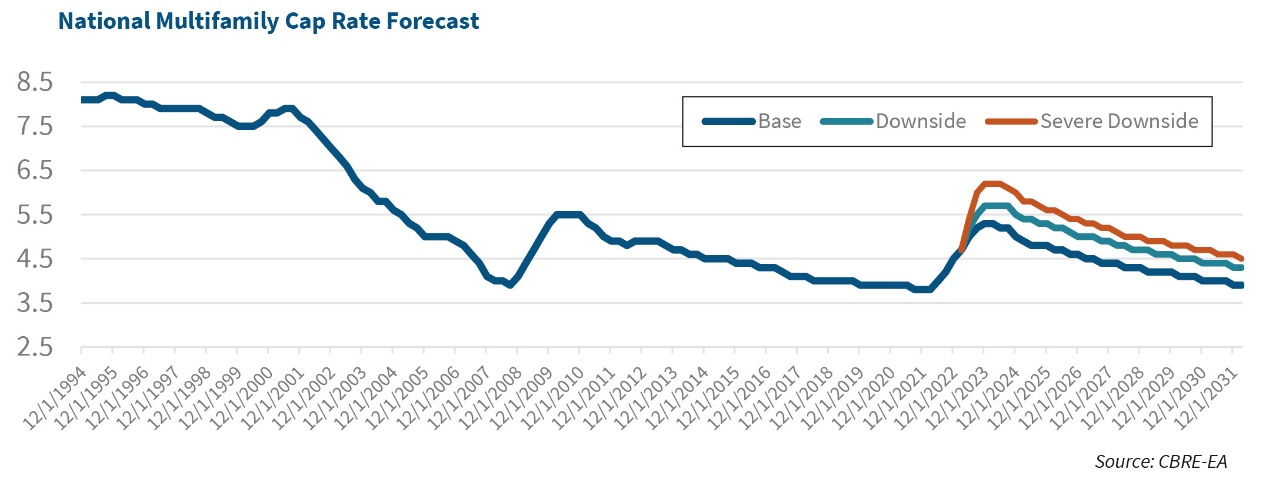

We are either looking at a market shift for a paradigm shift. With a combination of high prices, high insurance, and high interest rates most deals don’t make financial sense (won’t cash flow at least). Either we as investors are going to buy multifamily buildings with no prospect of cash flow (paradigm shift) or we are going to see prices decline in the short term (market shift).

I don’t personally think that the average investor in the average multifamily property is going to buy for appreciation ONLY. It’s just simply not worth the trouble. That leads me to the conclusion that either the prices are going to come down in the near future or interest rates are going to come WAY down SOON.

With the inflation metrics in the economy today I am betting that we see short term pricing fall before we see interest rates fall any appreciable amount. Other factors coloring this opinion are that taxes and especially insurance have been on an unpredictable rise lately. Aging infrastructure like plumbing and electrical are adding increased operational expenses as well.

While a cap rate below the interest rate presents a challenge, it doesn’t have to be a dealbreaker. By conducting a comprehensive analysis that factors in potential appreciation, tax benefits, leverage, and specific property characteristics, you can make informed investment decisions.

However, navigating this scenario successfully requires a deep understanding of multifamily market dynamics and financial modeling. Here’s your call to action:

- For experienced investors:Consider consulting a financial advisor specializing in multifamily investments to develop personalized strategies that leverage your expertise and risk tolerance.

- For those new to multifamily investing:Educate yourself further! Research market trends, delve deeper into financial modeling techniques, and consider attending workshops or seminars focused on multifamily investing.

Remember, “Money is made when the value is known.” By equipping yourself with the right knowledge and collaborating with financial professionals when needed, you can position yourself to capitalize on opportunities in the multifamily market, even when interest rates rise above cap rates.

While navigating a market where interest rates exceed cap rates can be complex, it also presents a unique opportunity for investors with the right guidance. I can help! I offer-

- Decades of Multifamily Expertise:Leverage my 20+ years of experience as a successful multifamily owner-operator to identify undervalued properties and craft winning investment strategies.

- Data-Driven Market Analysis:Gain a clear understanding of current market trends and historical performance through my in-depth analysis, empowering you to make informed decisions.

- Personalized Investment Roadmaps:Don’t settle for generic advice. My team and I will work collaboratively to develop a customized roadmap tailored to your specific risk tolerance, financial goals, and investment objectives.

- Expert Financial Modeling:Ensure your investments are built on a solid foundation with my financial modeling expertise. We will help you accurately assess potential cash flow, appreciation, and tax benefits to maximize your returns.

- Ongoing Support and Guidance:My team and I offer ongoing support and guidance throughout the investment process, ensuring you have a trusted advisor by your side as well as asset management services.

This article is not financial advice, and readers should conduct their own research before making investment decisions.

If you are interested in my consulting or asset management services you can get more information at my website www.realestateraw.com or email me directly at bill@gobroadwell.com.

Best of luck!

Bill Ham