A Step-by-Step Guide to Underwriting a Multifamily Property in 5 Simple Steps

Multifamily underwriting is the comprehensive evaluation of a multifamily property’s financial worth by considering three distinct valuation approaches: the income approach, the comparable sales approach, and the replacement cost approach. This process involves analyzing the property’s income-generating potential, comparing it to similar properties, and assessing its reconstruction costs. The value of the property can be arrived at by the combination of the resulting values of each approach.

Notice I used the word “value” not “price” in the above definition? This is because they are not the same thing and should never be confused for one another. Price is what you pay for something, value is what its worth. Only through the understanding of value can we arrive at the right price.

In this article I will focus on the math aspect of underwriting a multifamily investment. For explanations of the comparable sales approach and the replacement cost approach you can go to my site https://realestateraw.com/blog/.

Note-

This article does not provide financial advice nor legal advice. Seek the council of an accountant/lawyer before using any information here.

Step 1

Get the financial information for the property you want to analyze. The financial information you are looking for is what is called a “trailing 12” or a “T12”. A T12 is a profit and loss statement broken down into a month-to-month format. A standard profit and loss statement (P&L) is a financial summary of the last fiscal year for the property. A T12 in its month-to-month format extends back 12 months from the last month completed and does not begin or end with the fiscal year.

For example, a P&L for a property would be for the fiscal year ending 2022 or 2023. It would be one full year from Jan-Dec of that year. The T12 would be from October of 2023 trailing back to November of 2022 (or any month).

Step 2

Follow the basic formula for multifamily underwriting and deal analysis.

Income – Expenses = Net Operating Income (NOI)

NOI – Annual Debt Service (mortgage payment) = Cash Flow

Cash Flow / Total Money Invested = Cash on Cash Return (CoC)

When underwriting a multifamily investment, it is best to use one full year of financial data when analyzing the deal. Using less than 12 months of financial information may not give you a stable set of operating info for the property and increases the risk of miss analyzing the deal.

To calculate your annual debt service, you will need to have some lending information first. You need to know what price you are going to pay or offer for the property. You will need to know what the current interest rates are. You need to know what down payment you plan (or have to) put down. This is the loan to value or LTV given by the lender. Next you need to know what amortization the lender is offering. The most common amortization schedules today are 20, 25, or 30 years.

Note-

Loan amortization is the process of paying off a debt over time in regularly scheduled payments of principal and interest. Amortized loans typically have fixed payments, which makes it easy to budget for the loan payments. The payments are spread out over the life of the loan, which makes them more manageable than a lump sum payment. Amortized loans ensure that the borrower will eventually pay off the entire loan.

With this information you can calculate the annual mortgage payment or debt service. I suggest using a mortgage calculator for this such as the one in the Ultimate Underwriting Template.

Step 3

Decide how you plan to fund the deal. The math formula above assumes that you are going to be getting a loan to buy the property and put a portion of the purchase price down in cash as the down payment. The lender will fund the remaining amount (LTV).

I will cover an all-cash purchase next but for now let’s consider the loan aspect. If you are going to be using a traditional lender such as a bank or agency debt such as FNMA or FHLMC you will need to calculate the properties debt service coverage ratio (DSCR).

DSCR = NOI / Annual Debt Service

Most traditional lenders will want to see that the property is producing an NOI that has a DSRC or 1.2% to 1.3%. This means that for every $1 of mortgage payment the lender wants to see that the property has $1.25 or so in net operating income.

This is a basic understanding of what is called a DSRC loan. For this type of commercial loan, the lender is considering the income of the property to pay the mortgage payment, not your personal income. The catch here is that these lenders will most likely require that the borrower(s) have a net worth equal to or greater than the loan amount. Not the purchase price but the amount that the borrower (you) plan to borrow from them (LTV).

Step 4

Now that you have calculated the sellers NOI (from the T12) and you have calculated the annual debt service you formulate the cash flow. NOI – Debt Service = Cash Flow.

Now you move to the most important aspect of underwriting any real estate deal, multifamily or otherwise… it’s the “is it worth it” calculation. A deal may cash flow, but does it cash flow enough? When underwriting a deal, you may show that the property will produce X amount of cash flow in a % such as 5% cash on cash or 10% cash on cash. That is all well and good but consider it from the $ aspect. Is the cash flow enough actual money each month to be worth the work. This is what is called ROE.

ROE = Return on Effort

What is enough cash flow? My answer is that your property should produce enough revue to cover the entire capital stack with enough money left over to be worth the “brain damage” of dealing with the investment to begin with.

Below is a diagram explaining the Capital Stack.

In this figure the capital stack is separated into two sections. Debt and equity. The debt section is made of up the senior debt and any secondary debt. Senior debt is going to be the primary lender on the deal such as the bank and that loan (mortgage) will be in the “1st position”. In the diagram the “2nd position” debt is called mezzanine debt. In the multifamily business this is going to be a second mortgage (usually the seller carrying back a loan at closing).

The term 1st and 2nd mortgage are in reference to the order in which the loans are paid. 1st mortgage is paid first, and 2nd mortgage is paid second. In a default situation (foreclosure) the proceeds from the foreclosed property pay the 1st mortgage first and 2nd mortgage second. If there is anything left after that it would go to the equity position (owners).

The equity position of the capital stack is the money brought to the deal by the borrower(s). This would include the downpayment, the closing costs and any renovation money or cash invested into the deal for any reason (like fees). This can be broken down into common equity and preferred equity.

When discussing equity in a private multifamily investment it can be structured in several ways such as a sole owner, a joint venture (JV) or a fully syndicated structure including general partners (GPs) and limited partners (LPs) or even a tenant in common (TIC). In this article I am not going to break down each structure, but you can get more information on this subject in my article Equity Partners vs Debt Partners.

When describing preferred equity (Pref) or common equity in the capital stack we are discussing a syndicated deal with GPs and LPs. The equity in the deal (total value – debt) is owned by the GPs and LPs. If a preferred return is given to the LPs equity this means that all net profits (cash flow & sales proceeds) are distributed to this equity first before any net profits are distributed to the common equity (GPs).

Cash flow and profits will be distributed to the “pref” equity first but only up to a point. This is called the hurdle rate. The hurdle rate is return on investment set by the GPs when first creating the investment. All net profits are distributed to the preferred equity until the hurdle rate is met.

For example, if a multifamily investment is offering a 7% preferred return, this would mean that all cash flow and any profit at sale would go to the pref equity until a 7% ROI is met. After the hurdle rate is met, the syndicator may choose to do any form of distribution. A common form of distribution of profits above the hurdle rate is to share the profits based on a performance based tiered schedule. This is called a “waterfall” distribution schedule.

For example, an investment may offer something like a hurdle rate of 7% with a 70/30 split on the profits from 7%-10% and a 60/40 split if the deal produces 10%-12% ROI and a 50/50 split if it produces an ROI above 12%.

In the diagram of the capital stack, we see that risk is described as the highest as you move up the stack toward the common equity. This is due to the way any collected revenue is distributed. When rent is collected, primary debt is paid firs, second is paid second, preferred equity and lastly the common equity.

This is also true if the deal falls into a default situation (foreclosure) with the primary debt. In a foreclosure the primary debt will liquidate the asset and distribute the proceeds in the order of the capital stack.

Note-

It has been my (20 years) experience in the multifamily business that in a foreclosure there is usually no “extra” equity that makes its way past the primary loan. Second debt is usually worthless as is any equity position. Just saying.

Step 5

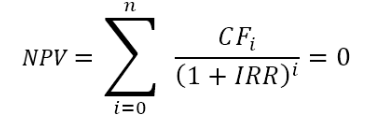

Use the income formula (or the Ultimate Deal Analyzer) to calculate the properties total rate of return. This is described as internal rate of return (IRR) or you can more simply calculate the annualized rate of return (ARR).

IRR is a complicated formula that have included here for reference. As you can see by the diagram below, you will want to use a calculator for that one, but ARR can be estimated quite easily and is used to quickly determine if the investment opportunity is even close to viable. If you find that your multifamily underwriting has determined that it is a good opportunity, you can go further in the analysis.

In MY OPINION a good deal is a deal that makes more money than it costs to own.

Basically, what I am saying is that a good deal is one that will produce more money than is consumed by the base of the capital stack (mortgage payment, investor returns, capex repairs, etc.).

If a property will pay out more than the base of the stack…you get paid. Simple as that. Depending how high up the stack your equity position is will determine the risk/reward for that multifamily investment opportunity. Underwriting complete.

IRR-

Annualized Rate of Return-

Total cash flow + Profit as sale = Total Profit

Total Profit / Total Cash Invested = Total Project Return

Total Project Return / Number of Years You Owned the Property = Annual Rate of Return

Annualized return is calculated by adding up all the cash flow for the years owned plus any profits at sale (appreciation and through paying the loan down). Add up all total profits and divide by the total amount you have invested in the deal. This will give you the total ROI for the deal. By dividing this number by the years, you owned the deal, you get your annual rate of return.

For example, if I invest $100,000 into a deal and the investment lasts for 5 years and get back $200,000 at the end of the 5 years would have a total rate of return of 100%.

I started out with $100,000 and 5 years later I have $200,000. I doubled my money or 100% ROI. If I divide the 100% ROI by the 5 years it took to create it, will have an annual return of 20%.

100/5 = 20

Conclusion

Find deals that make more money than is consumed by the capital stack. Sometimes this is done by paying the “right price” for a property. The less you pay, the less you borrow. The less you borrow the more you cash. Sometimes a good deal will be in the form of a “value add” deal or one that needs renovation to maximize the revenue and profits. Understanding creative financing for multifamily is also a good way to maximize the success of your underwriting.

For more information like this check out my blog at www.realestateraw.com and join my Facebook group Real Estate Raw for Multifamily Investors.

Best of luck!

Bill Ham