The Trifecta for Multifamily Mastery: 3 Systems for Long-Term Success

A 3 System Approach to Investing in Multifamily

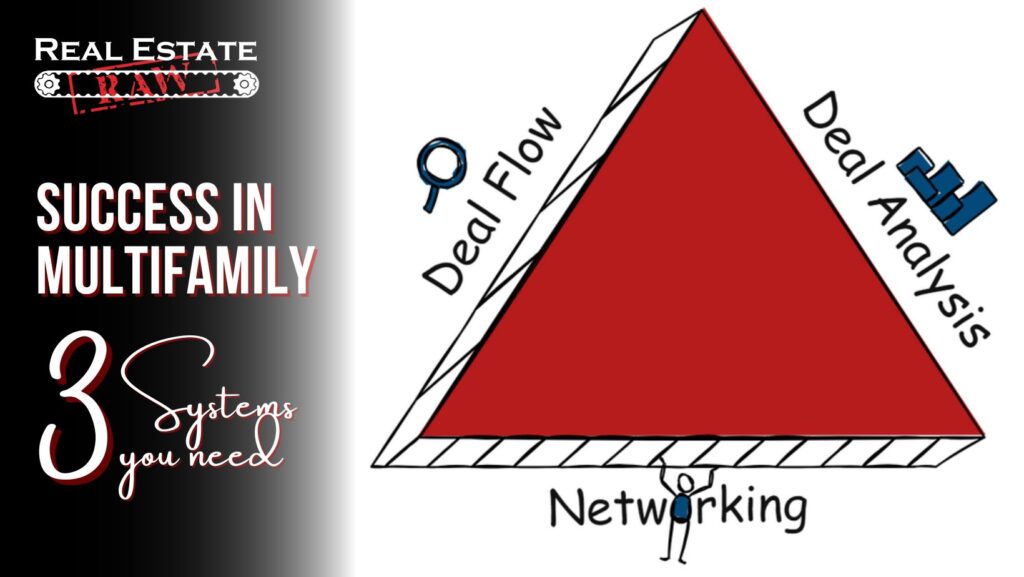

You need to always have three systems in place to be successful over the long term in multifamily investing. These three systems are-

- Deal Flow

- Deal Analysis

- Networking

Deal flow is the function of having a consistent set of potential investment opportunities come to you each week. For buying and investing in multifamily I suggest that you have at least three deals a week hit your desk. They key here is to have a strong understanding of what you are trying to buy. Are you looking for duplexes or 200-unit apartment complexes? Something in between perhaps?

To know what you are looking for, start with your borrowing capabilities. How much of a commercial multifamily loan can you personally qualify for? Don’t know- find out. Speak with some lenders and mortgage brokers to get an idea of what you can borrow. You may need partners for network or cash requirements. You will want to find this out early. Now split the real estate world into 80/20.

Now that you understand what you can borrow you will want 80% of your weekly deal flow to fall into that category. 20% of your time can be spent looking at deals that are larger than your current purchasing capabilities. Swapping these two numbers is a common mistake when people are new to the multifamily investing business. They try to go too big, too quickly and don’t get anything closed. Know where you are currently and start there! Go big WHEN you can.

Once you know what you are looking for, you can translate this to commercial realtors in your market. “What are you looking for?” is a multifamily realtor’s secret weapon. How you answer this one simple question can tell them everything they need to know about you and your experience as a buyer. Get it right the first time as you will only get “one bite at the apple” when it comes to first impressions with these agents.

Deal analysis is the ability to evaluate a multifamily property using one or a combination of these three valuation methods.

- The Income Approach

- The Comparable Sales Approach

- The Replacement Cost Approach

I have fully covered these three types of evaluations in other articles linked here but it suffices to say that you will need to know what a “good deal” is by using the three approaches to decide if a potential deal will make more money than it costs to own. If it makes less money than it costs to own, then it loses money. That part is easy, the real question is does it make ENOUGH money to be worth trouble in dealing with it. That’s what these valuation methods are used for.

I describe networking as the ability to fund real estate deals on a consistent basis. This comes from the adage “your network is your net worth”. I find this to be true for most investors and business professionals in general. Good relationships with good people makes making money a lot easier. If you make all the money, you will ever need to put into real estate from a job or other businesses, then you don’t fit this description. If you are not constantly flush with cash (like most investors) then you will be working with lenders and equity partners to build your business over time.

Your success in setting up your multifamily investment portfolio will consist of you creating systems for deal flow, deal analysis, and networking and operating them on a very consistent basis in each market you are buying in.

These three systems (like all good business systems) need to be scalable and adaptable to each of the market cycles. As your portfolio grows you will want systems for deal flow that grow with you and your experience. Your deal flow (like mine) may start with houses that you find through mail campaigns and end up with large multifamily assets bought through some of the largest real estate agencies in the market.

What’s a “good deal” today may not be the same thing in a different market cycle. Fixing and flipping is a great model in the upswing of the market but may not be so profitable when interest rates rise and cause the eventual shift in the market valuations.

Need help building your multifamily systems? Click HERE.

For more information like this check out my blog at www.realestateraw.com and join my Facebook group Real Estate Raw for Multifamily Investors.

Best of luck!

Bill Ham