How to Build a Real Estate Portfolio

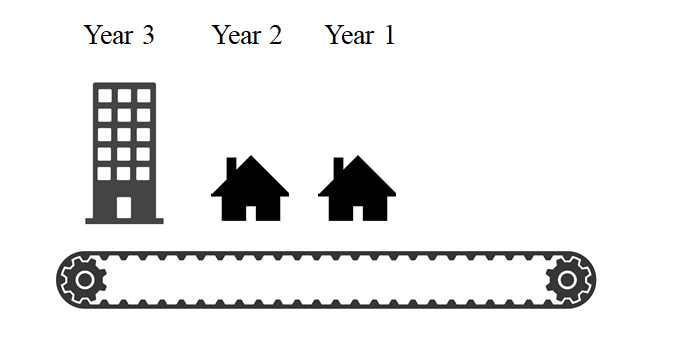

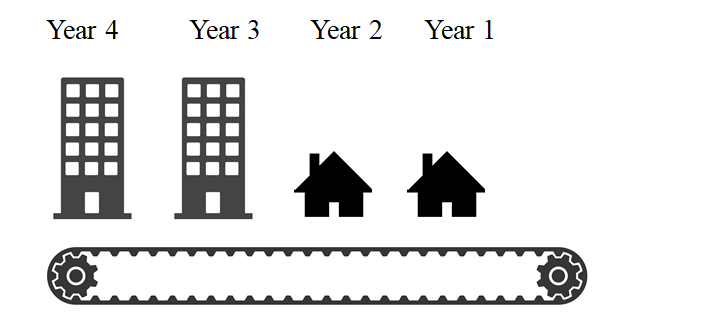

This is a concept I created to simplify the idea of building a real estate portfolio. Imagine a conveyor belt. Just like in a factory. Our conveyor belt will be 5 years long. This conveyor belt will represent your portfolio. As you add properties to your portfolio (conveyor belt) they will move along the belt from left to right. This represents time.

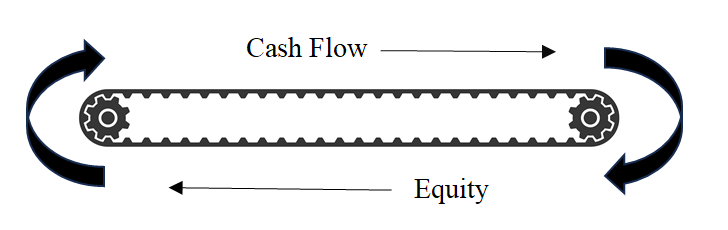

TIME and CASH FLOW ———->

Year number one you will begin by purchasing your first investment property. This will likely be a house or small multifamily property. The asset goes on our conveyor belt. I have chosen the length of the conveyor belt to be five years to represent what I consider to be the “average” hold time for most multifamily properties.

Year 1

The second year you have now purchased your second asset. You have moved up and are now buying small multifamily (or small commercial) assets.

Now in the third year you are fully operational and have built a small cash flowing portfolio. The third asset is a medium sized multifamily (or commercial) asset. You may also be syndicating deals now by using investor money.

Year four consists of adding a larger multifamily (or commercial) asset. You are operating and cash flowing the portfolio that is already on the conveyor belt. This is the point that you are getting some financial benefit from economy of scale. Perhaps you are considering bringing management “in house”.

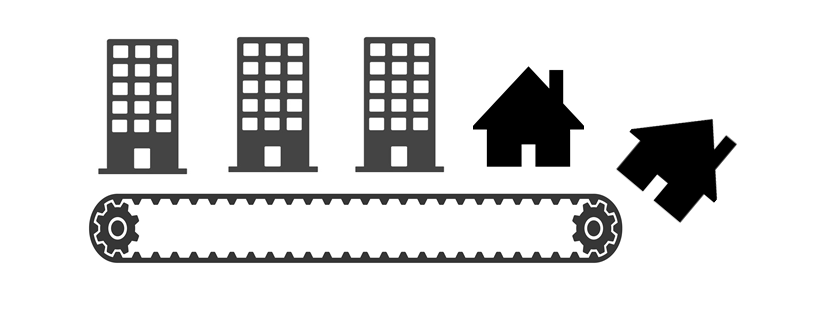

Year five brings us to our first liquidity event. We have been building, operating, and cash flowing the portfolio for five years and now we sell or refinance one of those first assets. This is the liquidity event. That property falls off the end of the conveyor belt.

Each consecutive year you will add one property will be added to the front of the conveyor belt (acquisitions) and one will fall off the back (disposition). Cash flow comes from the operations and capital gains comes from the liquidity event(s). As you sell and/or refinance over time you will create the equity needed to invest in the next deal. This will limit the need for future investors (LPs) and equity partners (GPs).

This simple diagram is not meant to represent financial advice but to give a basic understanding of how a real estate portfolio is built over time. As properties “fall off” the conveyor belt you will begin to replace them with better assets each time. This could be in the form of newer or higher quality buildings. Upgrade the portfolio whenever possible. Here are a few other points to consider.

“If a deal is cash flowing, why would I ever sell it?”

Profit for distress. Those (in my experience) tend to be the two main reasons people sell real estate deals. Cash flow is nice but if you buy low and the market appreciates the asset, you may get the opportunity to sell and realize years of future cash flow right now… in one big check.

The other reason is the deal (or partnership) has not turned out the way you want it to. This is usually do the aging condition of the building or the loan comes due, and you are forced to sell. If either of these happen, you are basically gambling. If the market is “up”, you win. If you become a motivated seller and the market is “down”, you lose.

“I want to build a portfolio for legacy wealth purposes.”

Have you ever seen a really old run-down apartment complex. Ever wonder who owns it? Your grandkids if you think leaving properties to heirs is a good idea.

Properties get old. They need work and capital expenditures over time. Sometimes this means old buildings stop cash flowing. This could be what happens to the buildings you plan to leave your family. Will they want to deal with it? Do they have the passion for real estate that you do? Are you going to turn your grandkids into slum lords?

I suggest that you consider the concept of leaving your legacy wealth in the form of the conveyor belt and not in any one asset. Leave the legacy of knowledge. Leave the legacy of a functional business to family members who understand how it was built and how it runs.

The 3 Pillars of Real Estate

The Three Pillars of Real Estate is a concept I first introduced in the book Creative Cash. These pillars are Debt, Exit Strategy, and Market Cycle. They are in no particular order, but all three must be understood to be successful over time in the real estate business. Here is a brief description of this concept but you can read the full article HERE.

Debt

You must know what types of loans (and terms) fit each project type. If you are going to fix up a property to sell for capital gains or if you plan to refinance in the first few years, you will want a short-term loan that does not come with heavy prepayment penalties.

Conversely, if you are planning to hold a property for many years, you would want the long-term loan that does have the prepayment penalties because the loan will not mature in the short term, and you will not pay the penalties if you hold the asset until loan maturity.

Market Cycle

Where is the market today? Where will the market be in two years, or five years? This is understanding market cycles. Obviously, no one can time/predict a market cycle perfectly, but you can get close if you understand the macro information that causes cycles (mostly inflation and interest rates).

Add debt and market cycle together to create a strategy for the loan. If the market is trending down (buyers’ market phase 1 or 2) then get longer term loans to ride out the market. If the market is trending up in value/pricing (seller’s market phase 1 or 2) then you will likely want to get a shorter-term loan that will allow you to capitalize on the rising values (refinance or sell).

Exit Strategy

Know the way out before you go in. The exit strategy is arguably the most important aspect of any real estate deal analysis. You need to decide the general business plan for the property. Is this asset going to be something you fix and flip? Hold and operate for cash flow? Long or short-term hold time?

Once you have decided what you are going to with the property you need to decide when that exit strategy is going to come to fruition (Market Cycle) and then make sure you get a loan (Debt) that fits your exit strategy/business plan.

If you combine The 3 Pillars of Real Estate with The Conveyor Belt Theory and you will have a full understanding of how a real estate business is built over time.

Conveyor Belt Challenges

Deal flow, deal analysis, and funding are the most important aspects of building your business but can also be the largest challenges. You need to have at least three potential deals on your desk each week (deal flow). You need to know if they are good deals or not (deal analysis) and you need to be able to fund these deals.

Finding good deals is always a challenge no matter what market cycle you are in. It has been my experience that you will “analyze” about 80-100 properties on average to get one to close. I say “analyze” because this could be anything from just going over the realtor’s offering memorandum or going to meet the realtor and doing a full property tour. Most of the time “analyze” will mean getting the financial information on the property and using a financial calculator to estimate the returns.

Implementing the Conveyor Belt Theory

This concept is not meant to be a “one size fits all” business model for real estate. Each investor will have their own specific type of conveyor belt. Some may only fix and flip properties. Here the conveyor belt theory is the same except for much shorter than five years.

Perhaps you plan to hold and operate a portfolio of new assets while slowly building equity and paying down the mortgage. Each investor, portfolio, exit strategy and individual property will be different but the basics of the business such as The 3 Pillars must be applied. Markets change and investment strategies change but the fundamentals are always here.

Conclusion

The Conveyor Belt Theory of Real Estate is a simple but powerful concept for building a successful real estate portfolio. By understanding the importance of time, cash flow, and liquidity events, investors can create a system that allows them to consistently add new assets to their portfolio while also generating income from their existing properties.

The key to implementing this concept is to have a plan. Investors need to identify their investment goals, determine their exit strategy, and understand the market cycle. They also need to build a team of reliable professionals who can help them to find good deals, close on time, and manage their portfolio effectively.

The Conveyor Belt Theory is not a one-size-fits-all approach to real estate investing. However, it is a valuable framework that can be adapted to different investment strategies and individual circumstances. By following the principles explained here, investors can increase their chances of success in the long term.

Here is a specific example of how an investor might use the Conveyor Belt Theory:

- Year 1: Purchase a small multifamily property using a short-term loan with no prepayment penalties.

- Year 2: Fix up the property and rent it out.

- Year 3: The property is now cash flowing and the investor is building equity.

- Year 4: The investor refinances the property using a long-term loan with low interest rates. This frees up capital that can be used to purchase another property.

- Year 5: The investor purchases a larger multifamily property using the cash flow from the first property and the proceeds from the refinance.

The investor continues to follow this process, adding new properties to their portfolio each year. Over time, the investor builds a substantial portfolio of cash-flowing assets.

The Conveyor Belt Theory is a powerful tool for real estate investors. By understanding the principles of this theory and developing a plan, investors can increase their chances of success in the long term.

For more information like this check out my blog at www.realestateraw.com and join my Facebook group Real Estate Raw for Multifamily Investors.

Best of luck!

Bill Ham