I was in the multifamily real estate business back in 2008 and I learned something from it. There are only 3 concepts you must understand to be successful in real estate. They are debt, exit strategies and market cycles. Get them right and you increase your probability of success greatly. Getting them wrong will almost certainly bring financial disaster. For the most part of my career, I have gotten them right… but a few times I have paid the price for getting them wrong. Looks to me like a few regional banks have violated the rules lately as well.

Recently we have seen the collapse of Silicon Valley Bank and Signature Bank. The collapse of these banking institutions was caused by depositors withdrawing more funds from the banks than they had immediate cash to cover. This is called a “bank run” and caused SVB and Signature to become insolvent.

To come up with the cash to cover the withdrawals of the depositors the banks had to sell some paper assets quickly. The issue is that the value of those assets (bonds and CMBS notes) was down due to the recent rise in interest rates.

If the banks didn’t have to sell those assets, then the devaluation would have been temporary and would have only been a loss “on paper”. Once the institutions HAD to sell, they converted the theoretical loss to a cash loss. Big difference. This is an unfortunate event but teaches us a great lesson.

You make money when you don’t have to sell. If you must sell an asset, you are only as lucky as the market itself is. That’s gambling not investing and remember… Las Vegas wasn’t built on winners.

The key to avoiding an unplanned exit from an asset is to understand what I call The Three Pillars of Real Estate. Perhaps I should have called it The Three Pillars of Business as it is just as applicable to any business as it is real estate. Even the banks aren’t immune. Here are each explained individually and then I will explain how this leads us to today’s situation in general.

The Three Pillars of Real Estate-

Exit Strategy

“Takeoffs are optional, but landings are mandatory”.

My flight instructor said this to me as I was going on my very first solo flight when I was training at the flight academy (many years ago). His point was that I had a choice to take off, but once I did takeoff, I had NO choice but to land. Wings up or wheels up, I was going to put that plane back on the ground.

Exit strategies are like this. You don’t have to close the deal but once you do, you must exit. In real estate there are only 3 exits. Sell, refinance, go into foreclosure. Once you buy a deal you will face one of these situations…eventually.

Knowing what you want to do with a property (or any asset) in the long run will allow you to analyze the deal correctly in the first place. If you don’t know what your exits strategy will be…chances are the market will decide for you. See you in Vegas.

Market Cycles

Now that we have decided what we are going to do with this asset, we need to calculate the hold time for it. Is this going to be a quick fix and flip? A cash out refinance? A sale? How long will that take?

This is the next step in your analysis process. How long will it take to implement the planned exit strategy and what market cycle will we be in at that time?

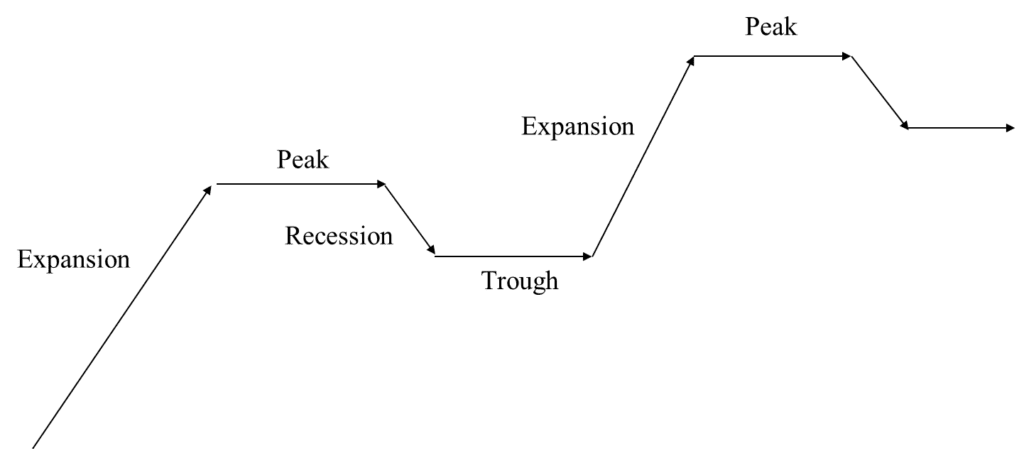

For example, if I am buying a property to fix up and refinance in two years, I would need to look at where I was in the market cycle today and then try and guess where the market may be in two years. You can never time a market perfectly (so don’t even try), but you don’t have to get blindsided by it either. The four business market cycles are expansion, peak, recession, trough and look something like this.

The real estate market values do not follow this diagram exactly. Prices tend to rise in the expansion period and then level off in the peak cycle. In some areas you may see the prices decline slightly off the high mark. Prices level off again in the trough cycle and hold for a few years followed by an eventual increase in price and value. This gives us the adage that “real estate always goes up in value”. I agree that prices will go up for the average asset given enough time (macro cycle) but in the short term (micro cycle) prices can whipsaw up and down dramatically.

Debt

Once you know what you are going to do with the property (exit strategy), and you know when you will have to exit (market cycle) you need to consider the loan (assuming you are not paying cash). Not all debt and lenders are created equal. Debt is like a tool. You need the right tool for the job.

Most people think about interest rates and down payment when they think of debt. I will suggest that in the grand scheme of the deal these will not be as important as length of term and leniency in the payoff. What I mean by this is that you need to understand your exit strategy and how long it will take to exit. Many loan products come with prepayment penalties such as defeasance, yield maintenance, step-down etc.

For example, if you buy a property and plan to fix it up and flip it (sell or refinance), you will not want to get a long-term loan such as a Fannie or Freddie loan. These debt products usually have massive prepayments if you pay the loan off early. You would lose most of your profit in the sale/refi to the bank. Ask me how I know that one!

Short term exit strategies need short term loans. Long term hold strategies need long term debt. The catch can be timing the loan term with the market cycle. Try to avoid having loans come due when in the trough or late recession cycle. The values/appraisals for real estate will be the lowest of the four cycles.

Conclusion-

You must always be ready to adapt to the market and change your buying, financing, and operating strategies according to the market cycles. What works today may put you at risk tomorrow (looking at you B.R.R.R). You make money in real estate when you don’t have to sell. Motivated buyers become motivated sellers. If you know what you are buying, why you are buying it, and what you plan to do with it, you have a great chance of success!

For more information check out my Facebook group Real Estate Raw for Multifamily Investors.