Source: Berkadia.com

Are multifamily properties in the United States going to stop cash flowing? Maybe.

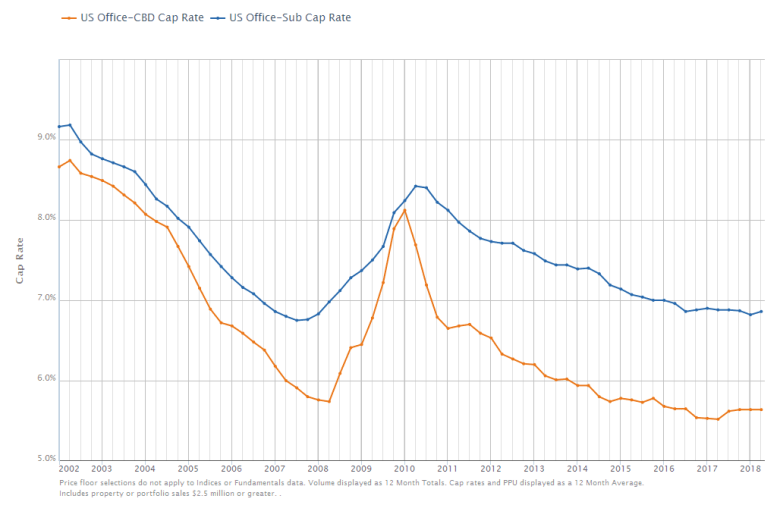

Over the last 2 decades capitalization rates (cap rates) have been steadily falling. The compression of cap rates basically means that investors are willing to pay more for less cash flow. Capitalization rate is the relationship between the price of and asset and the amount of revenue it produces. As investors pay more for assets the cap rates fall. In turn the cap rate rises as the income of the asset rises over time (rents being raised).

Real estate has always followed the traditional market cycles of business (Recession, Expansion, Peak, Decline). If this holds true, then the multifamily market is set for a pricing correction. If the current pricing trends hold true, then we are facing a new paradigm shift in the way we value income producing real estate as it will cease to actually produce income.

I have been having this conversation lately with friends and family.

Me- “Do you own any stocks?”

Them- “Yes, I do!”

Me- “Good. Do they pay a dividend?”

Them- “A few do, but most don’t.”

Me- “Ok, lets discuss the stocks you own that don’t pay a dividend. Over the last year or so did these stocks go up in value?”

Them- “Yes, they did?”

Me- “Why?”

The usual answer here is something like “the company is doing better” or something like that. I then ask if the stock is now paying a dividend (now that the company is more profitable)? The answer is always…no.

If a stock does not pay a dividend (cash flow) then why would the value go up? Is this the same way that we are going to value multifamily assets going forward. With no cash flow? Is this a new paradigm shift in the multifamily space or are we facing a future market decline in prices?

My point here is that if cap rates continue to compress, then multifamily will stop cash flowing and we will need to value these assets the same way that we value stocks that do not pay dividends. What will this method of valuing real estate look like? I don’t know but it won’t have anything to do with cash flow as a metric. People will pay more for the assets…just because?

I don’t think multifamily investors are ready to own multifamily without cash flow. I also think that prices will remain high for the near future. What does this ultimately mean?

It means that we may not go back to the returns produced by apartments over the last decade, but we will ultimately see higher cash flow than we do today. I am predicting prices of multifamily assets to follow the same pattern over the next few years. Prices will not necessarily decline but they will level off and not incline at the same rate that we have seen over the last five years. The result will be longer ownership periods before an owner will be able to sell or refinance. The total returns produced by multifamily will be the same just produced over a longer period.

If you are predicting prices of multifamily to rise over the next few years (cap rate compression), you are also predicting less cash flow or you are predicting rents to continue to go up. If you are predicting rents to continue to go up, then you are predicting high employment and wage growth over the same time frame.

If the U.S job market does not grow rapidly, wage growth will no longer support the rent growth. If the rents don’t continue to rise, then that low cap rate you bought stays low for a long time. No cash flow.

My suggestion- don’t overpay for real estate expecting future rent growth to save you. Buy for cash flow today!