Can your tenants afford your plumbing? Can you?

The U.S. faces a new challenge. The aging infrastructure in our real estate is a real threat to our future economy. More than you might think. In this article I will show you why the value of some of our real estate may not be what you thought.

As for “plumbing” I am using this as a general metaphor for capital expense (CapEx) costs to maintain a building. Any building. This concept applies to single family homes to large apartment buildings and everything in between. All buildings age. The aging infrastructure such as plumbing, electrical, roofs, parking, and HVAC (just to name a few) all cost money to repair and ultimately replace. Will you make money if you spend money on these replacements and upgrades? That depends. How much of a pay raise did your tenant just get at work?

My argument in this article is that with current and future inflation in the U.S. economy, job and wage growth will maintain steady at best will more than likely fall in the next few years to come. If your cost of operations increases due to the cost of CapEx, you will need to raise rents to maintain a certain level of cashflow and general profits. Rent growth is directly related to the tenant’s ability to pay that rent. That ability comes from wage growth. No wage growth, not rent growth. Not rent growth, well you get the idea. The pipes won’t fix themselves.

What is the solution? Pay LOTS less for aging commercial real estate. There, problem solved.

Ok, now back to reality.

The problem I am presenting here is a cost basis issue. A simple explanation of cost basis is the price you pay for something plus all the money you invest in it. The total cost of the investment. The issue comes when you don’t really know the future cost of something and you misvalue it today.

For example, buying an aged apartment building and not budgeting for high repair and replacement costs to the infrastructure of the building. Items that may not increase the revenue of the asset. If the roof leaks on a tenant, you are not likely to be able to charge a premium in rent for a unit that doesn’t leak but you are surely going to lose rent if you don’t FIX the leak.

I have been in the multifamily business for 20 years and I have come to decide that there are three types of repairs that can be done to a building.

- Revenue Creating

- Value Creating

- You Just Better Damn Do! (aka deferred maintenance)

Revenue creating repairs or renovations are ones that increase rents. In a multifamily investment this is usually done by upgrading cosmetics to the interior of the apartment. Things such as new paint, carpet, appliances, lights, etc. With the new and fresh look to the unit the owner/manager can usually raise the rent. This is instantly noticeable in the form of increased cashflow.

Value creating items are anything that will ultimately bring the seller a higher sales price in the future but may not directly increase revenue today. This would be noticed by a higher internal rate of return (IRR) over the years of ownership. When value items are done correctly, they can at times equal rent growth. For example, I replaced old wood siding with new vinyl siding on a 70-unit apartment complex that had been built in the early 1980s.

I made the upgrades because the building needed it but after my team and I completed the project, we had a lot of tenants and residents of surrounding neighborhoods stop by and tell us how great the property looked. The apartments fronted on a high traffic road in the middle of the city, so it was a high visibility address. Subsequently rents went up. A nice, but unexpected side effect of value creating renovations turning into revenue creation.

Deferred maintenance has no real value and you had just better damn do it or the property will start losing money. This category is where most of the hidden problem in our aging U.S. infrastructure lies. Fixing the old plumbing and electrical will not likely increase rents and you may not get a higher price just because you have made those replacements. What’s the solution? Pay less for the assets due to the real value. This can also be described as capitalization rates (Cap Rates) decompressing. Essentially buyers will pay less for the revenue and cashflow created by these aging buildings.

For more information on this check out my article- The American Cost Basis Crisis

Workforce Housing / Organic Affordable Housing / Naturally Occurring Affordable Housing (NOAH)

These are ways to describe aging multifamily assets in our economy. Some housing is built as affordable housing by issuing rent control at its creation. This includes the Low-Income Housing Tax Credit (LIHTC) properties. Investors in LIHTC projects receive tax credits from the federal government over a set period (typically 10 years). Units in LIHTC properties must remain affordable to low-income tenants for a minimum period (usually 15 or 30 years). Rents are restricted based on Area Median Income (AMI), ensuring they are accessible to those who qualify.

The properties that were built to be in the affordable housing program are not the focus of this piece since they tend to be newer in their condition (LIHTC program was established in 1986) and are also heavily regulated/inspected.

I am discussing the mid-size work force housing complex. The one down the street from you that was built back in the 1960 or 70s. Those smaller to midsize apartment complexes (20-75 units) that are owned by normal, everyday investors who bought that property as a retirement vehicle or as an asset to leave as a family legacy. The “Mom and Pop” operators of America that are the backbone of affordable housing in our economy. You and I and people just like us who invested in older multifamily assets when times were better.

As I mentioned in my previous article, Cost Basis is the main problem with organic affordable and workforce housing. Here is a basic formula for cost basis.

Cost Basis = Purchase Price + Closing Costs + Capital Improvements

Essentially, cost basis is what you pay for something plus everything that you invest into it. The issue arises when the cost basis exceeds or even approaches the after-repair value (ARV). In other words, the property won’t be worth what you have invested in it, and you certainly won’t make any money if you do complete the repairs.

Purchase price is a gift that keeps on giving… or taking. Paying too much for a property that has hidden distress in the infrastructure is what I call a CapEx Treadmill. You get on and you just can’t seem to get off. Repairs and replacements, one after the other, after the other—it never stops. All that cashflow literally goes down the drain right into the plumber’s pocket. How do I know?

The older a property gets the harder it becomes to accurately assess the needs and actual cost to repair or replace large systems like subflooring or electrical or roofs. Ask five contractors whether a roof or plumbing or anything needs to be replaced or repaired and you will get five different answers and at least five totally different quotes on pricing and timing. Promise!

How do you factor in this risk. Pay less. See my point? Older buildings are the backbone of our affordable housing in America, and we have a bigger problem than affordability in the sense that this topic is usually discussed. When someone mentions the “rent is too high” or housing is not affordable enough, I start to wonder what the rent is going to be when the plumbing blows up and the landlord still wants to take home some cashflow. No pipes = no cashflow.

What is the value of a building that will never again cashflow?

This is a question that has just begun to be asked in the multifamily market. Not openly but in the Bid-Ask Spread. The bid-ask spread is the difference between sellers asking prices and buyers bid prices. At the moment the bid-ask spread is a big-ass spread. There is a huge delta between what buyers are asking and what sellers are willing to pay today. Now let’s introduce high interest rates to this conversation.

High interest rates in the market only inflame the value divide between buyers and sellers. Now add deferred maintenance and we have a real valuation issue on our hands. Oh wait, I forgot about insurance. Ok, add deferred maintenance, plus high insurance costs, plus high interest rates, and now you start to get the picture. These old buildings won’t make money anytime soon.

A multifamily apartment complex (or any rental property) makes money in three basic ways. Cashflow, appreciation, and depreciation. Cashflow is profits created by rent collections exceeding the total operating costs plus any debt payments. Appreciation is the increase in the value of the asset and is only realized by a refinance or sale. Depreciation is the decrease in the taxable value of an asset.

The reason I ask the question about the value of a building that won’t cashflow is because there are essentially two ways to pay for renovations to property. Cash or Cashflow. That’s it. You can pay for all the renovations and repairs up front when you buy the building, or you can spend the next decade or so in cashflow slowly renovating the building. Either way you aren’t going to see any actual cash profits for a long time if ever. How do you solve this problem? Pay LOTS less for older buildings.

Are we headed for a market shift or a paradigm shift? Either prices are going to go down (market shift), or buyers will have to give up on the concept of cashflow coming from affordable housing (paradigm shift). All older buildings will have to make money form appreciation and depreciation only. No cashflow because it will all go to the cost of maintaining and managing the building. Personally, I think we will see a market shift and a large reduction in the value/prices of the older buildings before we see average investors buying these properties simply for tax write-offs.

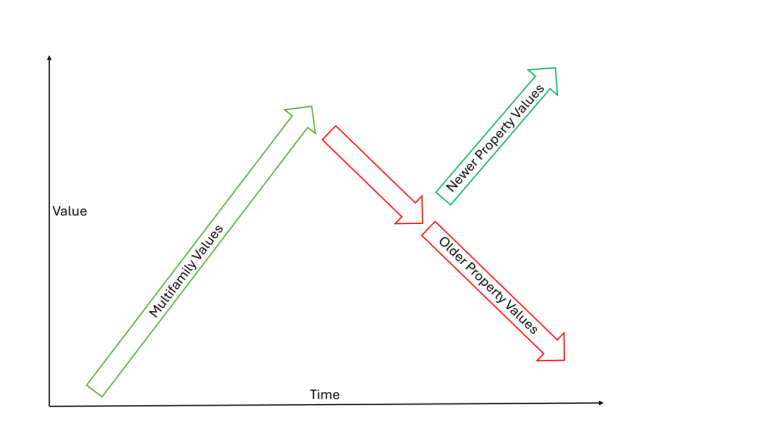

What I really think we are about to see is going to be “K” shaped market going forward. The newer buildings (A and B class assets) will continue to hold/climb in value while the affordable properties (C and D class assets) will crater in value.

This is an issue that the U.S. economy has never faced before. Never in our moder history have we had so much infrastructure reach its physical obsolescence all at once. From our roads and bridges to the aging housing of all types.

My unfortunate prediction is that due to the overwhelming cost to repair and replace the main systems of older multifamily buildings, the value and price will plummet over the next decade. If you purchase the building at the right price, you can then add the additional capital (cost basis) to renovate and still charge affordable rent. Remember your tenants’ wage growth will equal your rent growth.

Purchase price is a gift that keeps on giving… or taking. Paying too much for a property that has hidden distress in the infrastructure is what I call a CapEx Treadmill. You get on and you just can’t seem to get off. Repairs and replacements, one after the other after the other and so on. It never stops. How do I know?

My Conclusion and Suggestions

Buyers of multifamily assets-

Pay close attention to aging buildings as due diligence is difficult and expensive to do correctly.

The key to making money in this business going forward is going to be heavily based on cash flow as appreciation will come slowly as interest rates fall over the next few years. The key to producing cash flow in today market is to PAY LESS! I know that is easier said than done but time is on your side. You don’t have a mortgage, but the sellers do, and that mortgage is probably maturing soon (if not already). Be prepared and be patient.

Owners of multifamily assets-

Now is not a great time to sell unless you really need to. If you have unfortunately become a motivated seller, then you need to decide between money and time. The more time you have the more money you will make. If you are out of time (loan maturity) then it would be better to take a fractional loss than go into foreclosure and surely lose everything. Be patient and wait to sell if you can but if you can’t…don’t get greedy.

If you need help with your business feel free to reach out to me directly or check out other articles like this at my site www.realestateraw.com.

Best of luck!

Bill Ham