This article is adapted from my book Real Estate Raw.

As I have described in this book, the business of investing in real estate can be separated into several points: markets, deal flow, deal analysis, funding, operations, partnerships, and exit strategies. Lastly, I will show you what obstacles you can expect and how to overcome them.

These aspects of the real estate business hold true no matter what phase of portfolio building you’re in, but the skills and challenges you face will and do change as you grow. For example, getting a loan for a duplex is quite different from getting a loan for a one-hundred-unit apartment complex. Analyzing the value of a single-family rental property is different from a large self-storage facility. A portfolio of houses and small properties is 80 percent real estate and 20 percent business. Large assets and portfolios are 80 percent business and 20 percent real estate. When does it change? What new skills will you need to run a larger portfolio? What should you expect as your portfolio grows?

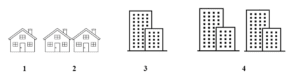

This chapter is about going from single family to larger commercial assets and will describe how the business changes as you build your portfolio. This chapter has four subsections, each one representing a phase in the building of a real estate business that starts with houses and goes into larger assets. The phases are shown in figure 8.

I will break each phase down into the aspects of markets, deal flow, deal analysis, funding, operations, partnerships, exit strategies, and obstacles, and I will show you how each one changes over time. Keep in mind that not everyone’s experiences will be the same and that no one business is built exactly in the same manner. This chapter is simply an outline of what you can reasonably expect to encounter.

Note: By larger assets, I mean any type of commercial real estate, not just multifamily, even though my examples lean toward multifamily.

Phase 1

The first phase begins with buying single and small multifamily (two- to four-unit) rental properties. When most of us get started in the real estate business, our main goal is to produce enough cash flow to quit our jobs. This is a great idea, but most people find out that it takes a while to get enough properties to produce adequate monthly cash flow to replace employment. The solution? Flip houses.

Fixing and flipping single-family houses is a great way to produce profits quickly. It’s not cash flow, but it’s cash, nonetheless. It comes in the form of capital gains from selling each house. I also include wholesaling properties in this beginning category. Now let’s look at the individual aspects of phase 1.

Markets. The area where you live will most likely be where you start looking for deals. Begin with your own part of town. Look for houses to fix and flip in your neighborhood or nearby. The closer to home you are, the better.

Deal flow. Going direct to owners is the best way to find single-family houses to fix and flip. Typically speaking, once a house is listed with a realtor, it may not be a good deal anymore.

Deal analysis. This is mostly a function of comparable sales in the area and cost basis. Follow the rule of 70. Your cost basis (purchase price + renovation costs) should not exceed 70 percent of the house’s ARV.

Funding. Any goes here. Use as much creative financing as possible. Hard money lenders are always available to fund a good fix-and-flip business.

Operations. Operations at this point of your business will be mostly about finding deals and working with contractors. The accounting here will be relatively easy. You won’t need much more than simple accounting software.

Partnerships. This will not come into play much here. Try to avoid partners in this phase.

Exit strategies. Sell the houses for quick cash. Pay attention to the market cycles to know what to pay for houses. Flipping works well in an up cycle and less so in a falling cycle.

Obstacles to Multifamily Investing.

Lack of experience, lack of money, lack of network, and low deal flow. Sound familiar? These were my problems when I got started in real estate. I overcame them, and so will you. Let’s address each one separately.

- Lack of experience

- There is nothing you can do about this, so just get started. At this point in business, education is key. Study, study, study. Take advantage of all the free information in the world, but don’t be hesitant to pay for good information from good teachers. Keep in mind that you will always pay for an education. You will pay to learn, or you will pay through your mistakes. The choice is yours.

- Lack of money

- Network for investment partners. You will need to find people who have money and who are willing to invest with you and help you get started. The question here is, what’s in it for them? Why would they partner with you? You must create value for your partners and investors. This gets easier with experience, so don’t become discouraged if you run into skepticism early on.

- Lack of network

- Meet more people.

- Low deal flow

- This one also takes time. Deal flow will be slow when you get stated but will pick up over time. The more time you spend looking at deals in your market, the more deals will come your way. This seems like an obvious statement, but the reason that you will find more deals the more you look is because of relationships and reputation. It takes time for people and sellers in your market to find out about you and to realize that you are a serious buyer. Ultimately your relationships and reputation will bring you more deals than any other source.

Phase 2

In this phase, you have started to realize that flipping houses is a full-time job. You have begun to consider keeping a few of the better ones for cash flow. Passive income starts to become a more attractive concept than quick capital gains. You begin to hold a few houses and small multifamily properties for cash flow. As a real estate entrepreneur, you will notice that real estate is a hybrid between investing and running a business.

Markets. Your market will now start to expand. You will be looking at a larger area where to build your portfolio, but it will still probably be concentrated in your hometown. You have not yet built any economy of scale, so don’t go too far from home.

Deal flow. At this point, you will start to implement more systems to produce deal flow. These systems will include direct contact with sellers (not realtors), but you will start finding some smaller commercial assets that will be listed with realtors.

Deal analysis. In the single-family market, the analysis of any one asset is largely based on comparable sales and the cost basis (purchase price + renovation costs). If someone is willing to pay a certain amount for houses in the area, then it is reasonable to expect that you can sell yours for something similar. As you move to commercial and multifamily deal analysis, the income approach becomes a mainstay of deal analysis.

Funding. Funding in this phase is still with community banks and local lenders. You will be working with hard money lenders, creative financing, and friend/family money most of the time. You will most likely be getting full-recourse debt in this phase. This means that you will probably have to personally guarantee the loans.

Operations. If some of your business is short-term renovation projects, you are now holding houses and small multifamily/commercial property for cash flow. At this phase, you should consider managing your own portfolio. This is good for experience and for your résumé. It’s in this era of your business where a true monster will rear its ugly head—accounting. Accurate accounting is at the core of any successful business. The sooner you embrace that, the better.

Note: I failed accounting at the college I graduated from in Macon, Georgia. I was flying airplanes at the time, and I was working part time as a flight instructor while finishing school (seven years total). I was on track for a bachelor’s degree in business administration when I ran into accounting.

I went to my accounting professor and told her that I was a pilot and that I was going to go fly for Delta Airlines, and if she would just show mercy on me and pass me, I would never practice accounting in my life, and I would never tell anyone she helped me get by. With monumental effort on her part, she did help me scrape by with a barely passing grade. The irony here is that ultimately, I was involved in accounting and bookkeeping every day when starting my company, and I tell this story all the time.

Partnerships. Partnerships will start to play a larger role in your progress now. Partners will mostly come in the form of private lenders who will move to become investors with you. They will see your growing success and want to work with you in more than just the lending capacity. Joint ventures will also be a prevalent structure at this point.

Exit strategies. You will likely still be fixing and flipping some properties, but you will start to implement the exit strategy of holding and refinancing.

Obstacles to multifamily Investing. As previously mentioned, this is when you will need to learn business as well as real estate. Thinking more like an entrepreneur and less like an investor will be the largest obstacle here.

Phase 3

The third phase of your real estate career will be dominated by the concept of going from an amateur real estate investor to a real business owner. Systems will be the new word of the day. You will be holding and operating more real estate than ever before. Your cash flow will be going up, but your business won’t look like it did when you started. In this phase, you will need to seriously consider managing your own assets—or not. By managing your own assets, you can create reliable income but at great opportunity cost. Managing your own assets will slow your acquisition of new properties.

Markets. To find larger properties, you must look much farther than your own neighborhood. You will need to choose markets on population growth. To successfully hold and operate a real estate portfolio, you will be extremely sensitive to your NOI. To increase the value of your portfolio, you will need to raise revenue. To do that, you must be able to grow rents, and to do that, you need population growth, not population decline or stagnation.

Deal flow. This will be tied closely to your market size. You need to be looking at three to five deals a week. Start with your local market, and draw circles on the map around your area, making them larger and larger until you incorporate enough viable cities to provide you with three to five new deals each week to analyze.

Deal analysis. At this phase, you will likely be starting to look at taking on investors. To bring on investors, you must adjust how you analyze deals. Now properties not only need to make enough cash flow to be worth your time but also need to produce returns to your investors. Your deal analysis will be largely based on how much ROI your investors require. The higher the return that they need on their investment, fewer and fewer properties will produce the needed cash flow.

Funding. You will now be working with more commercial lenders than with local community banks. You will begin to consider Fannie Mae and Freddie Mac loans. These loans will be disparate in their structure and terms from local bank and hard money lenders. Your past real estate experience will be a large part of qualifying for loans now.

Operations. Your systems (or lack thereof) will control your growth. You are becoming a real business now, not just an investor. Deal flow, deal analysis, bookkeeping, and reporting are just a few areas for which you will need strong systems in place to continue your growth. If you have chosen to hire a third-party property management company instead of bringing it in-house, then your time will be spent managing those managers or asset management.

Partnerships. This ties in with your lending. Lenders will be looking at the revenue generated by the property to cover the monthly mortgage payment, but they will typically want to see that you have the net worth equal to the loan amount before they lend to you. That’s where partners come in. Now your growth will be regulated by your team’s borrowing ability. If you want to buy larger properties, you need more net worth.

Exit strategies. Now exit strategies will start to include the reinvestment of capital gains. You will want to consider the highest and best use of your money. Why sell if you can’t put that profit to work in a new deal producing a higher rate of return? This question will begin to dominate your exit strategy analysis as you go forward. No one ever went broke cashing checks, but at the same time, there’s no need to divest of an asset that’s cash flowing if you can’t make more cash flow somewhere else.

Obstacles to Investing in Multifamily. Learning the art of using (and being responsible for) other people’s money will be the largest obstacle here. This will bring a new level of stress and profits to your business. Partnerships will largely fall under this same point. You will master the art of partnering here too. You will learn a lot about yourself and what type of person makes a good partner or investor for you.

Phase 4

In the final phase, you have moved to operating as a real business. You have figured out that passive revenue is not as passive as you thought, but that’s OK because you are in full swing with your real estate career now. You are fully competent in this business, and it takes infinitely less energy and stress to close new deals now. You will do deals because you want to, not because you need to. Real estate has now become 80 percent business and 20 percent real estate. You will finally realize that these buildings and properties are just your company’s product.

You will now be in the business of always turning your portfolio. This means selling off the lower assets in your portfolio and moving up to higher-quality assets with each transaction. The hallmark of this final phase will be holding newer assets for long-term cash flow and appreciation. You may want to consider bringing property management back in-house now.

Markets. Your markets in this phase of your business will likely cover one of the four quadrants of the country: Southeast, Northeast, Southwest, and Northwest. I consider my market to be anywhere within a one-hour flight out of my local airport.

Deal flow. You will be working with commercial realtors almost exclusively here. When you buy something directly from an owner, it will most likely be because you have purchased from them before. Professional relationships with industry leaders will provide most of your deals at this point.

Deal analysis. You will likely have staff doing this now. Deal analysis will be heavily weighted toward IRR and not cash flow anymore.

Funding. You will be working with agency debt (Fannie Mae and Freddie Mac) and other forms of commercial loans from a wide array of commercial lending sources. You will have long-standing relationships with commercial equity groups as well. This will include entities like family office groups and real estate investment trusts.

Operations. Now is the time to consider bringing the management of your portfolio back in-house. You will have enough assets to hire a team to manage them within your own company. This will create a new source of revenue without an unnecessary drag on your acquisition of new properties. You are now benefiting from economies of scale.

Partnerships. You will need fewer equity partners now. You have enough net worth and experience to take down most deals yourself or with a small group of close partners. You may choose to raise money from LP investors, but you will also be funding a large portion of your deals with profits created from the sale or refinancing of other assets in your portfolio. Money is now working for you.

Exit strategies. At this point, you will have mastered the three pillars of real estate. Your exit strategies will not change much from phase 2 to phase 3. You will continue to turn your portfolio in time with market cycles. Buy and hold until the right time to sell. You make money in real estate when you don’t have to sell.

Obstacles. Too much money can be an obstacle. At a point in time in your business, spending money can begin to create liability, not opportunity. Holding a lot of cash is not always the best investment strategy. Deploying capital into viable assets can be more challenging than you might think.

Mindset: Success Killer

Success kills success. This is an all-too-often truth in our world. You must constantly be changing and reinventing your business and your own mindset. Reaching a level of success in your life and in your business is great, but don’t get too comfortable. The day you stop looking over your shoulder is the beginning of the end. What got you here won’t keep you here. The best way to stay on top is to never get there in the first place. If you reach the top of an aspect of your life or business, start over.

Points to Remember

- You will evolve from an investor to a business owner and back to an investor again.

- In the beginning, you will be focused mostly on real estate and less on business.

- Over time your business will be focused on business systems and less on products (real estate).

For more information like this check out www.RealEstateRaw.com and join my Facebook group Real Estate Raw for Investors.

Best of luck!

Bill Ham