Being Fast is Good… Being 1st is Better!

How to Time the Multifamily Market Cycle Perfectly!

In my 20 years as a multifamily owner and operator I have been asked a lot of questions about timing the multifamily market such as “When to buy multifamily?”, “When do I Sell/Refinance?” “Is now the right time?” etc. In this article I will answer those questions and more on understanding a multifamily market cycle.

What is a multifamily market cycle?

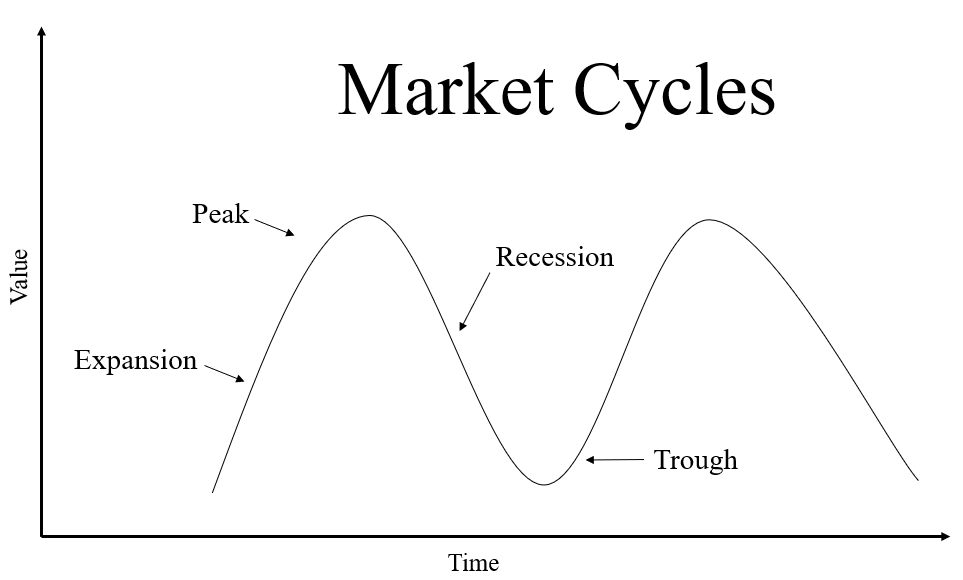

There are four general phases to a full multifamily market cycle. They are Expansion, Peak, Recession, and the Trough (Figure 1). These four phases occur in this order and may last several years each. A general full market cycle is about 10 years from peak to peak or trough to trough. All real estate market cycles are driven by interest rates. Interest rates are driven by general inflation in the economy. Therefore, it can be said that real estate (multifamily) market cycles are inflation based. What is actually “cycling” is known as the Bid-Ask Gap (Spread). This is the difference between what a buyer of a multifamily property (or any asset) is willing to pay versus what a seller of that same property is willing to accept in pricing.

Figure 1

Note-

Multifamily market cycles are also referred to as Recession, Recovery, Expansion, and Hyper supply.

As the bid-ask gap widens we see pricing and the market move from the expansion phase to the peak phase. This is also expressed in the stabilizing of capitalization rates for those assets. The time a property takes to sell (Days on Market) will increase. The onset of the Peak and the following Recession phase are typically triggered by rising interest rates offered by lenders for those locations. The increase in interest rates increases the cost of the debt and lowers the returns (cash flow) produced by the property. This is reflected in a lowering of the Debt Service Coverage Ratio (DSCR).

The peak and recession phase will be evident by the initial decline in transactions in the market due to the widening of the bid-ask gap. Lenders in the peak phase tend to tighten lending requirements from their borrowers as well. After a year or two in the recession cycle the market moves to the trough phase.

In the trough phase the market is “at the bottom”. Real estate will have become out of favor by most mainstream investors. Prices will be the lowest at this point. Lending will be restrictive and expensive. There will be deals everywhere but little interest or availability of funds for them.

Now the general economy has cooled off and has reached a point of stabilization where the government eases monetary policy resulting in lower interest rates and a resumption of real estate purchases. Pricing will remain flat for a short period as the transaction volume increases absorbing the least expensive assets first.

Pricing is on the rise in the expansion period “days on market” begin to shorten. Lending is in full swing and as a result the transaction volume reaches a peak and pricing follows. This results in the decline of cash flow and lowers overall investment returns, and the cycle begins again.

Figure 1 is an illustration of market cycles going from a point of $0 (Trough Cycle) moving to a peak of $100 (Peak Cycle) and then back to $0. This is not how the market actually moves in pricing or supply and demand. The cycles are more accurately reflected in Figure 2 below.

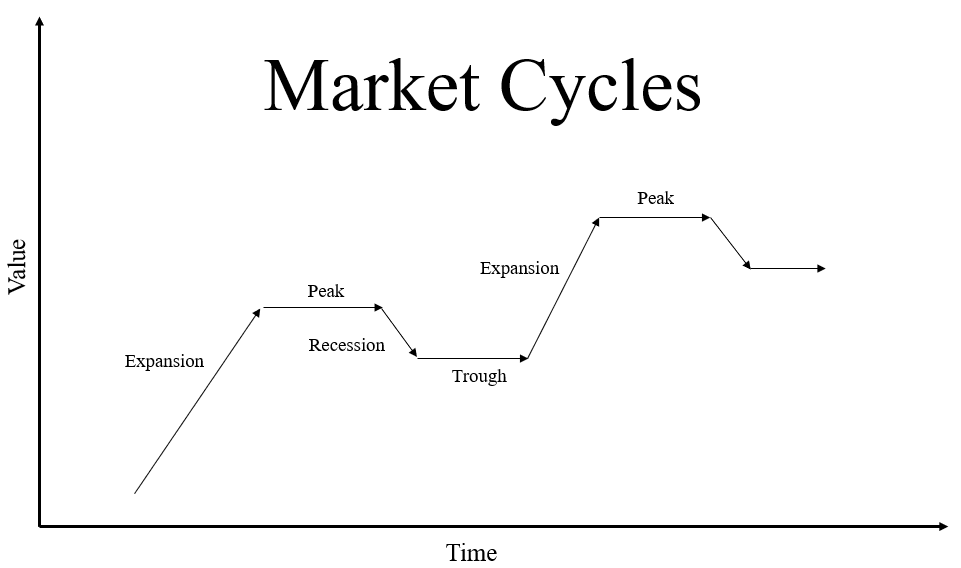

Figure 2

Note that the peak cycle is a flattened plateau followed by a slight decline in values that also level out for a while before beginning a new rise to a new high. This is a better image showing how the adage “real estate always goes up in value” is generally true…if given enough time.

Over a macrocycle in real estate (10-30 years) I would agree that real estate does usually go up in value but over a micro cycle (2-5 years) the values can swing heavily due to market conditions such as interest rates and availability of equity/debt.

Now that you have a basic description of a full multifamily real estate market cycle, we can discuss how to time that cycle perfectly.

Answer is- No, you cant. But you can get really close.

When people ask me how to time the market cycles I always say, “It’s easy to know where the exact top (or bottom) of the market is… you just look back over your shoulder a say “oh, there it goes”.

Fast is good but…

Having and understanding of real estate market cycles is not meant to give you a crystal ball to be able to “time” the market but to give you the ability to adjust your purchasing and debt strategies to move with the market and not against it. People try and “time the market” but they are never faster that those who were always there. Mastering market cycles will give you the ability to stay in the business long term despite the rise and fall of pricing and values. Never leaving the market is faster than timing it.

The 3 Systems

You need to always have three systems in place to be successful over the long term in multifamily. These three systems are-

- Deal Flow

- Deal Analysis

- Networking

Deal flow consists of having at least three different deals come to you each week for analysis. These deals will either be from working with realtors or by reaching out to owners directly. The key is consistency in having a stream of deals coming to you each week for analysis.

Deal analysis is in the understanding of what a “good deal” is. What is a good deal to you? How will you know when you see it? There are three basic methods for evaluating commercial real estate. They are the income approach, the comparable sales approach, and the replacement cost approach. A formal appraisal will take an average of the three values arrived at with each approach. As private investors we are focused mostly on the income approach followed by the comparable sales approach.

Networking is the overall ability to fund deals on a consistent basis. I put this under the category of networking because of the old adage “your network is your net worth”. This is very true for most real estate investors in the world. Some are what you would call “evergreen” in the sense that they produce enough cash a year (from work or other business) to buy all the real estate they want without banks or other people’s money. For the rest of us mortal investors we will need good relationships with financial institutions and equity partners to get where we are trying to go.

They key to long-term success is to build these three systems that adjust as the economy moves through these market cycles. A good deal is always a good deal but what you think of as a good deal will change based on the cycle phase. The expansion period is great for fixing and flipping (or refinancing) properties, but that model can lead to disaster if not adjusted when the market moves into the recession phase.

Understanding market cycles is crucial for any multifamily investor. While perfectly timing the market is impossible, this knowledge allows you to adapt your strategies throughout the cycle.

Focusing on consistently evaluating deals, understanding what constitutes a “good deal” in each phase, and building a strong network for deal flow and funding are the pillars of long-term success. Remember, staying active in the market and adjusting your approach as conditions change is far more effective than attempting to pinpoint the exact peak or bottom. By implementing these strategies, you can navigate the inevitable ups and downs of the market and achieve your multifamily investment goals.

For more information like this check out my blog at www.realestateraw.com and join my Facebook group Real Estate Raw for Multifamily Investors.

If you would like to find out about working with me directly, click HERE.

Best of luck!

Bill Ham